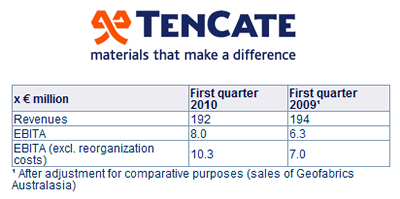

4 May 2010 – Operating result (EBITA excl. reorganization costs) increases autonomously by 43% in the first quarter of 2010:

4 May 2010 – Operating result (EBITA excl. reorganization costs) increases autonomously by 43% in the first quarter of 2010:

- Positive results from implemented restructuring

- Continued increase in operating result (EBITA excl. reorganization costs) expected for first six months of 2010 as a result of a sharp increase in the result in the second quarter.

KEY DEVELOPMENTS

Protective Fabrics

- Temporarily lower sales of fire-resistant fabrics for US Army, in part due to innovation in camouflage print; higher revenues planned for second half of the year

- First commercial order in European market (Norway) for TenCate Defender™ M

- Strong order position in emergency response (firefighting market) and industrial markets in the US, in part as a result of the market launch of the TenCate Tecasafe™ Plus product

- Order positions in Europe (mainly industrial markets) are at considerably higher levels than in the past year

- Provision of more than € 2 million for reorganization relating to the concentration of Dutch production at a single location that is to be implemented.

Space & Aerospace Composites and Armour Composites

- Positive effects on the result from the reorganization implemented in 2009 (Dutch production)

- Strong and diversified order position for armour composites in Europe and the US, with deliveries planned for the second half of the year

- Strengthening of position in the British armour market through the acquisition of AML UK

- Sales of aerospace composites (mainly related to Airbus) remain unchanged at a low level, although the outlook will improve over time; there is a slight recovery in the market for aircraft interiors

Geosynthetics

- American market shows substantial recovery; upturn in infrastructure market and strong developments in TenCate Geotube® applications (water management, environmental solutions)

- Sluggish start by European geosynthetics market due to longer winter period

- First commercial project outside Europe for TenCate GeoDetect® (sensoring); collaboration agreement entered into with Roctest.

Grass

- Approximately 10% rise in sales, partly as a result of the positive price effect

- American market shows structurally strong demand

- Considerably higher results through reallocation of production and the cost measures taken earlier

Other Activities

- TenCate Enbi shows clear recovery in results with increasing sales

- Xennia Technology records good progress in the strategic objectives that were communicated to stakeholders in February

Mr L. de Vries, President and CEO of TenCate: “The operating result before amortization for the first quarter of 2010 showed an autonomous increase of 43%, excluding the provision for reorganization costs (approximately € 2 million). The effect of the American dollar in particular on the operating result was approximately -6%.

“Net profit does not show a representative picture for the first quarter, due to a number of fiscal items. On an annual basis, however, no significant change in the tax rate is expected.

“The decline in the group’s sales is mainly attributable to timing issues relating to the purchase of army uniforms by the US Army. The market share of TenCate Defender™ M is growing, partly due to the number of new applications in a number of army units. The first major order has also been secured outside the US, which is a pleasing development in the context of a larger geographical spread of sales.

“No sales of TenCate Gen2™ were generated in the first quarter. In the second half of the year new orders are expected for this product with the new camouflage print (multicam) specified by the US Army. TenCate Defender™ M will also be available with this camouflage print.

“The armour markets in the US and Europe are showing a very promising outlook, although government funding remains an uncertain factor at present.

“The outlook has improved in the aerospace market, given the large programmes (Boeing 787, Airbus A380, A350 XWB and A400 M) that are starting to become apparent. The recently agreed order position for Eurocopter also supports this positive trend, although these effects will increase in importance over time.

“It is gratifying to note that the order intake in the European market for protective fabrics is developing positively. By contrast, further concentration of Dutch production is necessary. In the course of the year we shall embark on plans relating to the concentration of production. An appropriate provision has already been made for this in the first quarter.

“The cautious recovery that is now discernible in a number of markets, including the US geosynthetics market, is a positive factor. The announced public sector expenditure is gradually becoming visible in a growing projects market.

“The positive effects of the reorganizations that were implemented at business unit level are clearly evident, in particular in the Grass group.

“No further reorganization costs within the group are planned for the rest of this year.”

Outlook

Virtually all markets are showing the first signs of recovery. It is, however, too early to make any statements in respect of the expected trend in sales and result for the year as a whole. One of the reasons for this is the continuing uncertainty relating to government financing and the timing of defence contracts.

The positive image seen in the first quarter is expected to gather momentum in the second quarter.

A sharp increase in the operating result before amortization of intangible assets (EBITA) is expected in the second quarter of the year.

CONTACT

Frank Spaan, Director Corporate Development & Investor Relations

Telephone: +31 (0)546 544 977

Mobile: +31 (0)612 961 724

E-mail: f.spaan@tencate.com

Internet: www.tencate.com

ABOUT TENCATE

Royal Ten Cate (TenCate) is a multinational company that combines textile technology, chemical processes and material technology in the development and production of functional materials with distinctive characteristics. TenCate products are sold worldwide. Systems and materials from TenCate come under four areas of application: safety and protection; space and aerospace; infrastructure and the environment; sport and recreation. TenCate occupies leading positions in safety fabrics, composites for space and aerospace, antiballistics, geosynthetics and synthetic turf. TenCate is listed on NYSE Euronext (AMX). www.tencate.co

m

RELATED LINK

Tencate Profile on Geosynthetica