NOTE: This is an abbreviated version of the full Ten Cate press release. We have included the introductory notes and the primary details on the Geosynthetics & Grass division’s performance. Read the entire release here (PDF).

**

Highlights of 2011

Highlights of 2011

- Growth in sales of 16% to € 1,139 million (+12% organic)

- Operating result (EBITA) up 21% to € 102.5 million (+27% organic)

- EBITA margin in 2011: 9.0% (2010: 8.6%)

- Net profit up 28% to € 58.7 million

- Advanced Textiles & Composites: strong growth in sales and substantial increase in operating result

- Geosynthetics & Grass: growth in sales and non-recurring decline in operating result

- Dividend proposal: € 0.95 per share (+27%), in cash or as a stock dividend at shareholder’s discretion (2010: € 0.75 per share, stock dividend option)

Loek de Vries, president and CEO: ‘In 2011 TenCate continued the upward trend that started in 2010, as a result of which sales and profit once again rose sharply to record levels. Sales and net profit amounted to € 1,139 million (+16%) and € 59 million (+28%) respectively.

The Advanced Textiles & Composites sector recorded a very strong performance, in part as a result of the excellent positioning of the protective fabrics portfolio (including TenCate Defender™ M and TenCate Tecasafe® Plus) and through growth mainly in the sales of aerospace composites.

This growth in sales was accompanied by a rise in the EBITA margin of this sector to 13%.

The Geosynthetics & Grass sector saw a rise in sales of 12%, although the development in results was disappointing.

TenCate Geosynthetics put in an excellent performance worldwide with innovative products and large-scale TenCate Geotube® projects.

The results of the Grass group came under pressure, in part as a result of the ending of an important supply contract. Because of economic conditions TenCate will refine its strategy in respect of synthetic turf activities. This will be implemented at an accelerated pace to achieve further cost reductions and to serve the market more effectively.

Most core activities enjoyed a successful year, in which the global growth of “performance materials” was clearly manifested. This has created positive expectations for the future.

These expectations are in part based on the leading market themes of safety and protection as well as infrastructure and the environment. These themes will ensure growth in the longer term. Developments that will accelerate growth for the next few years relate to the TenCate ABDS(TM) active blast countermeasure system (vehicle armour), automotive composites, 3D weaving technology (synthetic turf) and inkjet technology (protective fabrics). This will enable the cornerstones of product differentiation and technological innovation from the business model operated by TenCate (value chain management model) to be further developed’.

2011 Full-year figures

Sales for 2011 amounted to € 1,139 million (2010: € 985 million). In organic terms sales increased by 12% (currency effect -3%; effect of acquisitions / divestments +7%).

Organic growth occurred principally at the Advanced Textiles & Composites sector. The TenCate Protective Fabrics market group recorded an excellent performance. The Space & Aerospace Composites and Advanced Armour market groups also developed strongly. The consequent increase in the results is in part attributable to a substantially higher result at the composites production facility in the Netherlands. This development is principally due to the increased production of new Airbus aircraft (A380 / A350 XWB).

The Geosynthetics & Grass sector showed a mixed picture. TenCate Geosynthetics developed favourably, but the sales of the Grass group came under pressure.

EBITA rose in 2011 by 21% to € 102.5 million (organic +27%; currency effect -6%).

The good performance within the Advanced Textiles & Composites sector resulted in substantial growth in EBITA. As a result of the trend in sales within the Grass group, there was pressure of a passing nature on the operating result of the Geosynthetics & Grass sector.

The net profit for 2011 rose by 28% to € 58.7 million (2010: € 46.0 million). Net earnings per share amounted to € 2.31 (2010: € 1.84).

PERFORMANCE BY SECTOR

Geosynthetics & Grass Sector

|

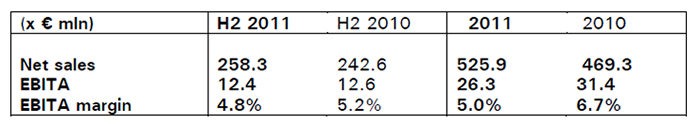

Sales in 2011 rose in organic terms by 2% to € 525.9 million (currency effect -3%; effect of acquisitions / divestments +13%). On the one hand, sales rose at the TenCate Geosynthetics market group worldwide (+16% organic), on the other hand, there was a decline in the sales of synthetic turf yarns (-16% organic).

The EBITA for 2011 declined on an organic basis by 7% to € 26.3 million. The currency effect and the effect of acquisitions / divestments amounted to -7% and -2% respectively.

TenCate Geosynthetics put in a strong performance. Throughout the world TenCate is more and more often involved in larger infrastructure and environmental projects. A new development that is enjoying great interest is the detection of subsidence and underground leaks, to which TenCate, with TenCate GeoDetect®, is responding. In such system solutions TenCate works closely with environmental consultancy firms, construction companies and dredging companies.

TenCate Grass has not been able to fully compensate for the initial loss of volume resulting from the ending of the relationship with a major customer in 2011. In the synthetic turf market both the number of installations and the price of sports pitches also came under pressure in the course of 2011.

A number of new high quality US and European market players affiliated themselves with TenCate during the year, which constitutes a further strengthening of the downstream activities. The formation of a geographically strongly represented downstream activity is expected to be completed in the course of 2012.

The full press release is available here (PDF).

Royal Ten Cate (TenCate) is a multinational company that combines textile technology with chemical processes and material technology in the development and production of functional materials with distinctive characteristics. TenCate products are sold throughout the world. Systems and materials from TenCate come under four areas of application: safety and protection; space and aerospace; infrastructure and the environment; sport and recreation. TenCate occupies leading positions in protective fabrics, composites for space and aerospace, antiballistics, geosynthetics and synthetic turf. TenCate is listed on NYSE Euronext (AMX). www.tencate.com