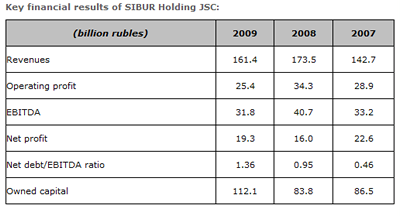

11 June 2010 – According to the consolidated financial results for 2009, JSC SIBUR Holding revenues fell year-on-year by 7% down to 161.4 billion rubles with an EBITDA* decrease by 21.9% to 31.8 billion rubles. However, net profit increased by 20.6% and reached 19.3 billion rubles.

The main factor behind the decrease in revenues and EBITDA was the fall in the demand for petrochemical products and the narrowing of the price range both in domestic and foreign markets. Net profit grew due to the sale of non-core assets (the methanol business), the decrease in spending on the profit tax and the use of financial insurance instruments based on changes in exchange rates.

Investments in production expansion and modernization totaled 27.6 billion rubles in 2009 (33.6 billion rubles in 2008).

In spite of the economic crisis, the company managed to implement such major projects as putting into operation the second phase of the Yuzhno-Balyksky gas processing plant, wastewater treatment facilities at the Voronezhsintezkauchuk plant and installations for the production of geosynthetic materials, as well as the upgrading of the ABS/PC composites production at the Plastik plant. Moreover, the company launched production of new types of rubber at the Voronezhsintezkauchuk plant and the Krasnoyarsk synthetic rubber plant. A new cable plasticate production line was launched at the Kaprolaktam plant in the Nizhni Novgorod region. The company continued to finance the construction of the largest in this country plants to produce polypropylene in Tobolsk and PVC in the Nizhni Novgorod region.

As of the end of 2009, the net debt to EBITDA ratio was 1.36 matching the international average for the sector. This leaves the possibility to add to the debt burden for the implementation of the investment program.

In 2009, JSC SIBUR Holding’s main shareholder Gazprom with the purpose of financing the development of the company contributed to the authorized capital of SIBUR Holding 9 billion rubles through the additional issue of shares. Registration of the issue of 3,469,545 shares with the face value of 1,000 rubles a share was completed in January 2010.

Last year, the company made some changes in the composition of its assets. Among noteworthy events should be mentioned the acquisition of the international petrochemical trader CITCO and a 50-percent stake in Biaksplen Ltd. Russia’s largest manufacturer of BOPP film.

“In the situation of a total economic stress, we have managed to preserve financial and production stability of the company,” SIBUR President Dmitry Konov said. “Our strategic development is associated with the implementation of a full-scale investment program, the perfection of marketing instruments and the reduction of operating costs.”

|

CONTACT

Media Center

SIBUR LLC

+ 7 (495) 937-17-26

press@sibur.ru

* EBITDA, which stands for “Earnings Before Interest, Taxes, Depreciation, and Amortization”, is calculated as earnings net of payments for income tax, as well as incomes and expenditures from financial operations and depreciation.