On December 5, Switzerland-based Sika AG (VTX:SIK), a chemicals specialty company, was surprised by a rival’s takeover bid. France-based Saint-Gobain (EPA:SGO), which has substantial holdings in construction, announced plans to acquire 16% of Sika through purchasing the Burkard family’s ownership stake in Sika; through a unique company ownership structure related to the Burkard’s historical involvement with the company, Saint-Gobain’s acquisition of those shares, which are worth a 52.4% voting share, would give it a controlling interest in Sika AG.

On December 5, Switzerland-based Sika AG (VTX:SIK), a chemicals specialty company, was surprised by a rival’s takeover bid. France-based Saint-Gobain (EPA:SGO), which has substantial holdings in construction, announced plans to acquire 16% of Sika through purchasing the Burkard family’s ownership stake in Sika; through a unique company ownership structure related to the Burkard’s historical involvement with the company, Saint-Gobain’s acquisition of those shares, which are worth a 52.4% voting share, would give it a controlling interest in Sika AG.

Sika’s management reacted swiftly with its objections.

Both companies interact with the geosynthetics market. Sika’s waterproofing technologies (e.g., Sikaplan® geomembranes) are used in tunnel construction, greenroofs, and other containment situations. Saint-Gobain’s ADFORS division is involved in pavement and mining reinforcement applications (e.g., with the GlasGrid® and GlasPave™ materials).

On December 9, Sika released a statement to investors in which the company noted that Schenker Winkler Holding AG, which holds 10% of the company’s share capital, had requested to convene an extraordinary general meeting. Multiple board of director positions were proposed to change.

On December 17, it was announced that Sika would meet with investors to discuss the impending transaction between Saint-Gobain and the Burkard family.

A presentation for investors has been published online.

Bringing the two companies together might primarily alter their shared landscape in cement and concrete production and construction. In those sectors, they are significant competitors with differing approaches to how they’ve operated and planned for future capacity growth as well as how they’ve sought to protect themselves against Europe’s slowed construction market and geopolitical instability.

Sika maintains that the takeover would hinder its growth by giving a rival significant control over Sika’s activities while Saint-Gobain would have limited exposure (16%). Sika contends the takeover would present conflicts of interest for shareholders, the companies’ boards, and management. And the company strongly objects to the consolidation plans within the proposal.

Saint-Gobain has said it would keep Sika listed. Its offer included an 80% premium on the share price for the Burkard family’s stake, but no offer has been extended to public shareholders. Some Sika shareholders are concerned now about the ability of Sika to expand in markets in which Saint-Gobain is active if the two companies attempt to operate independently.

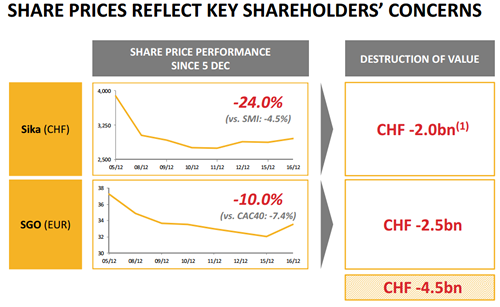

The lack of an offer for the publicly held shares may be responsible for the quick drop in share price. Sika’s share price dropped almost 25% from December 5 – 16. Saint-Gobain’s fell 10%. The drops represented more than CHF 2 billion (USD 2 billion) for each company

The deal seems inevitable, however. Sika has conceded a willingness to talk. As with many mergers and acquisitions, it is a matter of finding the right price and internal or operational assurances. Sika is pushing for a larger role in guiding the potential synergy between the companies and more information for public shareholders to consider.

The regulatory approval process on the transaction would be conducted in the first half of 2015. The Wall Street Journal reported that Sika’s books would be consolidated into Saint-Gobain as soon as the second half of 2015.