By Lee Buchsbaum – The sweeping new federal rules on handling and storage of coal ash may lead to the single largest increase in the geosynthetics market in 20 years. The US Environmental Protection Agency conducted a long study on the health risks and technical strengths of nearly 700 coal ash facilities at power plants nationwide. The resulting rule change, which takes effect in May 2015, will transform the way coal combustion residuals (CCRs) are to be handled, stored, and impounded.

The change affects how new and existing storage and slurry ponds are to be sited, designed, regulated, inspected, and lined.

Historically, coal ash—primarily produced by power plants—is one of the largest industrial waste streams in the United States. The American Coal Ash Association’s (ACAA) Coal Combustion Product Production & Use Survey Report estimates that nearly 110 million tons of CCRs were generated by 450+ coal-fired electric plants in 47 states and Puerto Rico in 2012. Other estimates range as high as 160 million tons.

The EPA’s new regulations, widely supported by industry, are a response to several unfortunate accidents. A Duke Energy impoundment suffered a sizable breach (140,000 tons) in February 2014, which spilled into North Carolina’s Dan River. The high-profile failure of Tennessee Valley Authority’s (TVA) Kingston, Tennessee facility spilled 4.2 million m3 of slurry across 300 acres in December 2008.

Duke Energy has agreed to pay USD $100 million in a settlement for its breach. The TVA cleanup cost has exceeded USD $1 billion.

COAL ASH RULE CHANGE

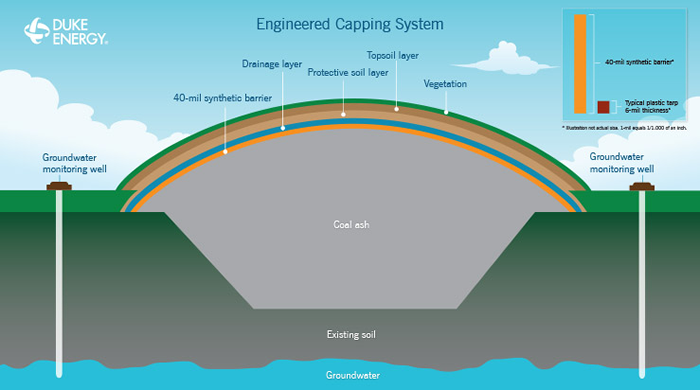

All new impoundments will also have to include lining systems, composite barriers, or both, in following the RCRA Subtitle D regulations that have made the US municipal solid waste management sector so effective. Nearly all existing CCR facilities will need to retrofit or close within 10 years.

“[This is] the biggest increase in the geosynthetics market that’s happened in one small sum in 20 years,” says Boyd Ramsey, chairman of the Geosynthetic Materials Association’s Executive Council and Chief Engineer at GSE Environmental. He compares it to the creation of the Resource Conservation and Recovery Act (RCRA), which helped jumpstart the entire geosynthetics industry.

“Going forward,” Ramsey says, “we’re going to have to put coal ash in an engineered facility. And for the next five or six years, you are going to have to cap, close, or retrofit existing operations. That’s what’s really going to drive the market in the near term.”

The amount of handling represents a market increase of 10 – 15% for the geosynthetics industry. The closure of existing facilities, however, represents an additional 20% increase.

Closure will involve multi-year projects and the re-handling and management of CCRs.

The EPA’s extensive study rated more than 20% of the current surface impoundments in “poor” condition. A high risk is posed by 50 ponds. The majority of these facilities are in the Midwest, Southeast, and Texas, where coal-fired utilities are plentiful.

The historical build up of coal ash is dramatic. The US has more than 735 surface impoundments, containing 3.1 – 3.8 billion tons of slurry. Though CCR generation is forecasted to gradually decline, as more utilities switch to or incorporate more natural gas, coal ash will remain a significant industrial waste stream. Coal-fired power plants produce more than a third of the nation’s electricity.

EXISTING CCR FACILITY CHALLENGES

When existing CCR mounds are wetted, such as being exposed to precipitation, water percolation can mobilize the ash and increase the risk of an unlined containment berm failure.

“There’s some really strong performance track records of capping big ash storage facilities with a geosynthetic membrane to prevent those kinds of events,” says Ramsey. “Once you put a waterproof cover over it, you’ve solved 80 to 90% of your problem.”

Existing facilities will begin taking such measures in 2015.

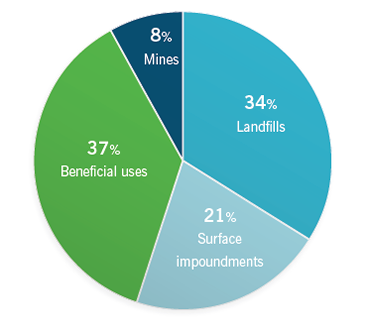

Currently, CCR disposal occurs at more than 310 active on-site landfills. The average storage facility occupies 120+ acres and waste depth exceeds 40 ft. The 735 active on-site surface impoundments occupy on average more than 50 acres and feature a depth of 20 ft.

PERSPECTIVE FROM COAL-FIRED UTILITIES

Though the new rules may force some power producers to change course, most power companies have cooperated with the rulemaking process. The change has seemed imminent since the Kingston failure, so utilities have had time to assess risk and plan for transition.

American Electric Power, one of the largest coal-fired generators in the US, and perhaps the largest aggregated producer of CCRs historically, agrees with the EPA’s findings and the implementation schedule of the new rules.

“Where closure of impoundments will be needed under this rule, the EPA is providing adequate time to implement the closures safely,” says Mellissa McHenry, director of external communications for AEP.

AEP operates dozens of CCR storage facilities, including some on EPA watch lists. The utility already has ground-water monitoring systems in place at most of its impoundments.

“We have developed a plan to close, dewater, and permanently cap all but two of our existing eight fly ash ponds,” says McHenry, “and will close a total of 20 ash ponds. Many of these pond closures will be at plants that will be retiring in the next year. The schedule for this closure process will vary from plant to plant based on site-specific characteristics.”

Though all facilities are treated the same way under the laws, facilities larger than 40 acres can get a 10-year extension awarded in two-year increments.

ENORMOUS SCALE, BUT A READY SOLUTION

“With the amount of waste that needs re-handling,” says Ramsey, “it’s unrealistic to think all the large facilities are going to close within three years.”

Some sites, for example, exceed 700 acres; but that scale is not an indication of poor practices. Larger mounds result from the size and duration of burn rates for power plants that report to each facility.

At the end of the day, the EPA will likely scrutinize only facilities that have demonstrated ground water contamination and are still accepting fresh CCR loads. These facilities will have to run the full gauntlet of regulations, as EPA is concentrating on the highest risks of public harm.

It’s safe to say that the new regulatory certainty allows the utility sector clarity. It also establishes clear timelines to adapt operations and achieve compliance.

For the geosynthetics industry, it’s time to roll up its collective sleeves and start lining, pushing, and stacking some of the largest piles on the planet. The challenge is great, but the engineering is readily achievable.

**

Lee Buchsbaum is a Colorado-based freelance journalist and photographer with 10+ years experience documenting and writing about coal mining, energy industries, and the environment.