Highlights of third quarter of 2011

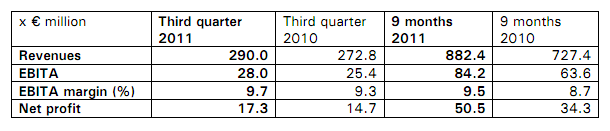

- Revenues €290 million (autonomous +6%, currency effect -5%)

- EBITA €28.0 million (autonomous +13%, currency effect -6%)

- Net profit up by 18% to €17.3 million

- Positive trend in sales of TenCate Defender™ M and TenCate Tecasafe® Plus

- Strong growth in aerospace composites and geosynthetics

- Sales of synthetic turf fibres and armour materials fall short of expectations

|

Loek de Vries, President and CEO of TenCate:

‘The sales trend in protective fabrics, aerospace composites and geosynthetics was positive. The order position in the European market for armour materials developed favourably. The focal point of these sales will be in the fourth quarter. The US market for armour materials and the synthetic turf market were sluggish.

‘Net profit increased in the third quarter by 18% to €17.3 million. Net profit growth for the first nine months was strong (+47%).

‘TenCate expects to achieve record sales and profit from operational activities for 2011 as a whole. There is ongoing market consolidation and strategic repositioning taking place in the synthetic turf activities, in which TenCate plays a leading role. The situation on the financial markets and the tightening of local authority budgets has resulted in restraint in respect of invitations to tender for synthetic turf projects, particularly in southern Europe and the US’.

Key developments in the third quarter by sector

Advanced Textiles & Composites

- Sales of TenCate Defender™ M and TenCate Tecasafe® Plus remained at a high level.

- A cooperation agreement was entered into with Chinamex for the introduction of flame-resistant fabrics onto the Chinese market in 2012.

- The volume growth in aerospace composites also had a positive effect on the capacity utilization rate, particularly on production in the Netherlands.

- The armour composites market in the US was sluggish; the order position in Europe developed favourably.

- The demand for composite materials outside the aerospace and armour markets increased; the automotive industry, in particular, is an important potential area of growth.

Geosynthetics & Grass

- Sales of geosynthetics showed a positive trend on all continents. The relative proportion of sales in South America and Asia rose. Emas Kiara was integrated within TenCate Geosynthetics Asia.

- The earlier adverse effects of the increased costs of raw materials were offset by price increases within the Geosynthetics group.

- Within the Grass group there was a decline in sales compared to 2010, as a result of the termination of the delivery contract with a major customer. There was also a decline in the market volume of synthetic turf in the third quarter. This decline occurred mainly in the US and in southern Europe.

- TenCate downstream activities in the synthetic turf market showed an autonomous growth in revenues of 17% in the third quarter.

- Market launch of fully recyclable synthetic turf systems by Edel Grass and GreenFields. These systems were produced using TenCate’s new patented weaving technology.

Other activities

- In the third quarter TenCate Enbi presented an identical picture to that of 2010. Sales in Asia continued to increase.

- The revenues of Xennia Technology grew rapidly. Sales consisted mainly of components and sales of inks still remained limited.

Other information

Investments made during the first nine months of 2011 amounted to €17.3 million (2010: €13.3 million). Net financial expenses rose by €1.4 million to €8.5 million, principally due to a higher interest rate on loans. Compared to the third quarter of 2010, the debt position increased by €73 million to €317 million. This can be attributed to acquisitions and higher working capital. The debt ratio amounts to 2.23; at the end of the third quarter of 2010 it still amounted to 2.54.

Outlook

TenCate expects to achieve record sales and profit for 2011 as a whole.

Future sales of TenCate Defender™ M to the US Army are expected to be in line with the involvement of US military personnel in foreign missions. At the same time TenCate will introduce protective fabrics based on TenCate Defender™ M and TenCate Tecasafe® Plus technology in a number of new geographical markets and in market segments other than defence.

About Tencate

Royal Ten Cate (TenCate) is a multinational company that combines textile technology with chemical processes and material technology in the development and production of functional materials with distinctive characteristics. TenCate products are sold throughout the world.

Systems and materials from TenCate come under four areas of application: safety and protection; space and aerospace; infrastructure and the environment; sport and recreation. TenCate occupies leading positions in protective fabrics, composites for space and aerospace, antiballistics, geosynthetics and synthetic turf. TenCate is listed on NYSE Euronext (AMX). www.tencate.com

Contact

Royal Ten Cate

F.R. Spaan, Corporate Director, Business Development

Tel.: +31 546 544 977

Mobile: +31 612 961 724

E-mail: f.spaan@tencate.com